Word of the Day: Cassandra

Today’s word of the day comes courtesy of the Merriam-Webster dictionary website, and it is, I think, the first time that I have gone with a proper noun (a name) for my word of the day. The name is Cassandra. According to the dictionary, Cassandra refers to “a daughter of Priam endowed with the gift of prophecy but fated never to be believed”; but more broadly, it refers to “one that predicts misfortune or disaster” (https://www.merriam-webster.com/word-of-the-day). The dictionary then goes on to give this version of the myth of Cassandra:

The story of Cassandra comes from Greek mythology and is both tragic and ironic, as such myths tend to be. Cassandra was the daughter of Priam, the king of Troy. She caught the eye of the god Apollo, who was accustomed to getting what he wanted. He was amazed and displeased when she refused his romantic advances, and he became vengeful. He cursed Cassandra with a gift of prophecy with an especially cruel twist: he guaranteed that while she would always be right, no one would ever believe her predictions. Cassandra foretold the fall of Troy and other disastrous happenings, though she was ignored. Now, the label Cassandra is typically reserved for those who claim to see impending doom.

The etymology website says that the word has been used in the figurative second sense since the 1660s. It also tries to explain the origin of the name: “The name is of uncertain origin, though the second element looks like a fem. form of Greek andros ‘of man, male human being.’ Watkins suggests PIE *(s)kand- ‘to shine’ as source of second element. The name also has been connected to kekasmai ‘to surpass, excel,’ and Beekes suggests a source in PIE *(s)kend- ‘raise’” (https://www.etymonline.com/search?q=cassandra).

On this date in 1929, 91 years ago, the Stock Market in the USA saw he sale of over 16 million shares of stock, most of them at a loss. This day is called Black Tuesday. Although the market had begun what they call a correction the week before, many consider Black Tuesday to be the beginning of the Great Depression. While some 650 banks closed in 1929, around 1300 closed in 1930. In 1933, $140 billion was lost during bank failures.

You might wonder why the Stock Market crashed in 1929, and it’s kind of a story, but I’ll try to keep it brief. The 1920s were a boom time for the USA. The world was recovering from World War I, and the USA was supplying goods to Europe and the rest of the world. With the expansion of the economy, the Stock Market grew, rapidly. But toward the end of the 1920s, business was slowing down. The unemployment rate in the 1920s was below 5% except for a couple of brief recessions in 1924 and 1927, but it jumped from 4.6% to 8.9% in 1930, and it got worse from there.

Even during times of economic contraction, the Stock Market continued to improve, in part because people were able to borrow money in order to purchase stocks. As long as the increase in the value of the stocks exceeded the interest rate, the people investing borrowed money were winning. And through the summer of 1929, they seemed to be winning. But what they didn’t count on was the fact that if the increase in the value of the stocks was less than the interest rate, they would lose money. And if the value of the stock actually decreased, they would be on the hook for borrowed money with no means of repaying it.

According to www.history.com, there was at least one person warning the country about what was to come:

Economist Roger Babson was one of the most prominent prophets of doom, concluding that stock prices were wildly inflated compared to the prospect of future dividends. In September 1929, Babson told a National Business Conference in Massachusetts that “sooner or later a crash is coming which will take in the leading stocks and cause a decline from 60 to 80 points in the Dow-Jones barometer… Some day the time is coming when the market will begin to slide off, sellers will exceed buyers and paper profits will begin to disappear. Then there will immediately be a stampede to save what paper profits then exist.” (https://www.history.com/news/1929-stock-market-crash-warning-signs)

Babson was absolutely right, but nobody believed him. Irving Fisher, a Yale economist, “famously told a crowd of stock brokers that stock prices had reached ‘what looks like a permanently high plateau.’ That was on October 15, 1929” (ibid.) Fisher was a well-known economist before the Crash, and his prediction badly hurt his reputation. However, it has recovered, and he is somewhat influential today. Roger Babson, on the other hand, is remembered enough to have a Wiki, but I wouldn’t call him influential.

It’s funny how the Cassandras of the world are forgotten, whereas people like Irving Fisher and Karl Marx become influencers. But I would beware influencers bearing gifts.

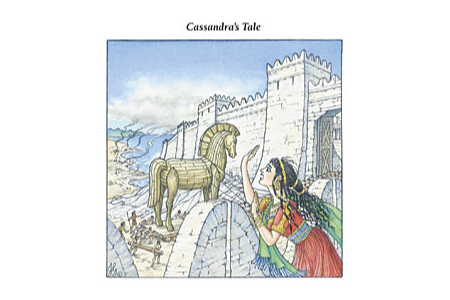

The image is from http://www.rechargebiomedical.com/cassandra-syndrome-welcome-to-my-world/ and represents Cassandra’s warning the Trojans against accepting the supposed gift of the giant horse from the Greeks. The phrase is not from Homer’s Iliad but from Virgil’s retelling of the story of the Trojan War at the beginning of the Aeneid: Timeo Danaos et dona ferentes “I fear the Danaans [Greeks], even those bearing gifts” (https://www.thoughtco.com/beware-of-greeks-bearing-gifts-origin-121368#:~:text=The%20adage%20%22Beware%20of%20Greeks%20bearing%20gifts%20is,that%20masks%20a%20hidden%20destructive%20or%20hostile%20agenda).